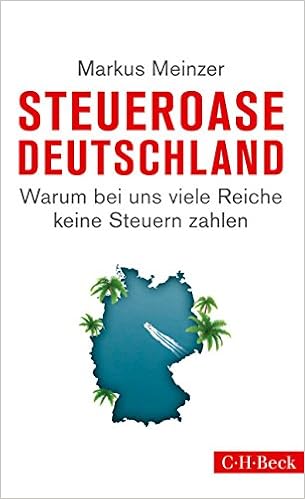

Germany is a safe haven for dictators’ loot, the assets of organised crime networks, and the proceeds of tax crimes and other illicit financial flows from around the globe. In his September 2015 book Tax Haven Germany, TJN researcher Markus Meinzer calculated that the amount of tax exempt interest-bearing assets held by non-residents in the German financial system ranged between €2.5 - 3 trillion as of August 2013.

Germany’s global scale weighting in the FSI is 6.0, meaning it has a six percent share of global offshore financial services – though not as large as the United States, United Kingdom or Luxembourg, whose shares are respectively around 20 percent, 17 percent and 12 percent. Germany’s secrecy score of 56 places it in the lower mid-range of the secrecy scale, roughly equivalent to those of Japan and (a much-improved) Luxembourg.

However, behind this moderate secrecy score lie areas of great concern.

While there has been some recent progress with Germany’s international treaty commitments and anti-money laundering framework, there are still major loopholes and many implementation deficits. Germany has shown negligent enforcement of anti-money laundering rules, and it offers a worrisome set of secrecy facilities and instruments, such as bearer shares, which were outlawed or severely restricted long ago in many ‘classic’ tax havens. Like many other OECD countries, Germany does not sufficiently exchange tax-related information, automatically or otherwise, with a multitude of other jurisdictions. Many foreign-owned assets in Germany are held secretly through elaborate structures spanning secrecy jurisdictions such as Cayman Islands and Switzerland. And Germany’s willingness to police its financial sector in these areas is woefully inadequate. Germany has flown under the radar for too long: it is one of the world’s bigger secrecy jurisdictions, and needs to be understood as such. (more...)

No comments:

Post a Comment