Last year the Panama Papers scandal shook the world and lifted the lid on murky offshore dealings in spectacular fashion. The political consequences and investigations, criminal and otherwise are far from over. The European Parliament set up the Panama Papers inquiry committee tasked with investigating “alleged contraventions and maladministration in the application by the EU Commission or member states of EU laws on money laundering, tax avoidance and tax evasion.” Today Bloomberg reports that the committee begins a series of ‘secret fact-finding meetings’ in London for two days. It has come to the heart of the beast.

We have always said that the Panama Papers could just as well have been branded the ‘British Virgin Islands Papers’, since that British Overseas territory was revealed as a Mossack Fonseca favourite, whose most important secrecy offering comes from it’s “lax, flexible, ask-no-questions, see-no-evil company incorporation regime.”

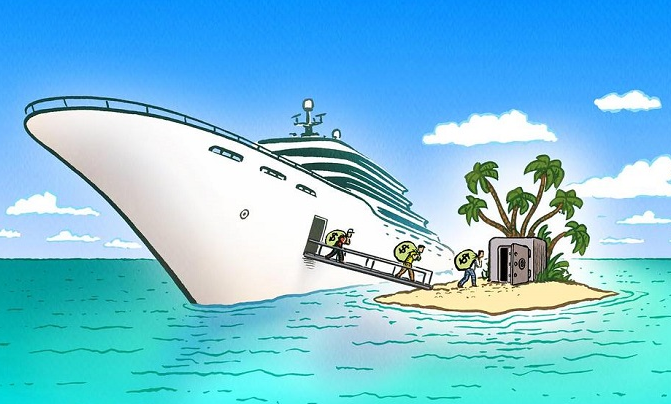

The UK has a special responsibility to take a global lead on tackling financial secrecy. The United Kingdom runs a global network of Overseas Territories and Crown Dependencies that includes some of the world’s biggest tax havens — including the Caymans, the British Virgin Islands, Bermuda and Jersey. If all of the UK’s satellite jurisdictions were rolled into one, the UK would be number one in the Tax Justice Network’s Financial Secrecy Index. (more...)

No comments:

Post a Comment